The "Customer Credit Status" page is designed to make it easier for Credit Controllers to follow up on overdue payments by making the relevant information readily available in one place.

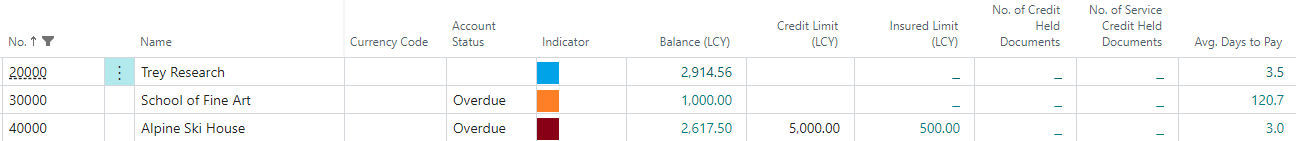

The list displays details Credit Control information for each Customer, showing information such as the Payment Terms Code, Balance (LCY), No of Credit Held Documents, Overdue Balance, the Insured Limit (LCY) from the "Customer Card" and the Aging of Amounts owed.

You can see here the Indicator field is brought across from the "Ageing Bands" setup page to show the appropriate colour for the ageing band the customer is in. This is just a visual representation of the ageing band, you can use the other fields detailed further below to get more information on their status.

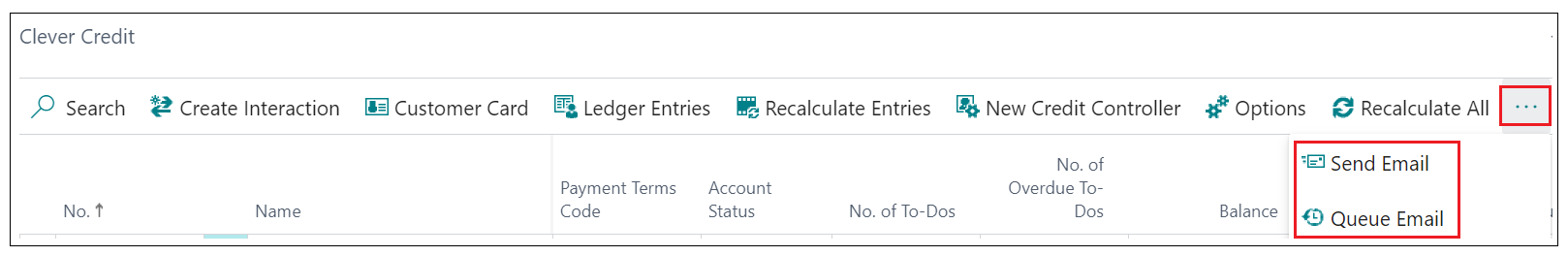

The actions in the ribbon give you quick access to information that helps decision making. The Customer Card can be accessed if any information needs to be checked, displaying the "Customer Card" for the line you have currently selected. The Ledger Entries are available to show a filtered list of the 'Open' Ledger entries for that customer. Recalculate Entries will update the amounts for any Customers that have had postings to their ledger and update the values shown on screen accordingly, whereas Recalculate All will refresh the whole page of data and all Customer ledger entries regardless of whether the values have changed since the screen was last recalculated. As this task could be quite intensive, it is advised to run this out of hours.

If any action needs to be taken for a Customer, you can use the Create Interaction action from the ribbon to record the interaction and the outcome. This will automatically create a "Credit Control To-Do" once actioned. More information on To-Dos can be found here.

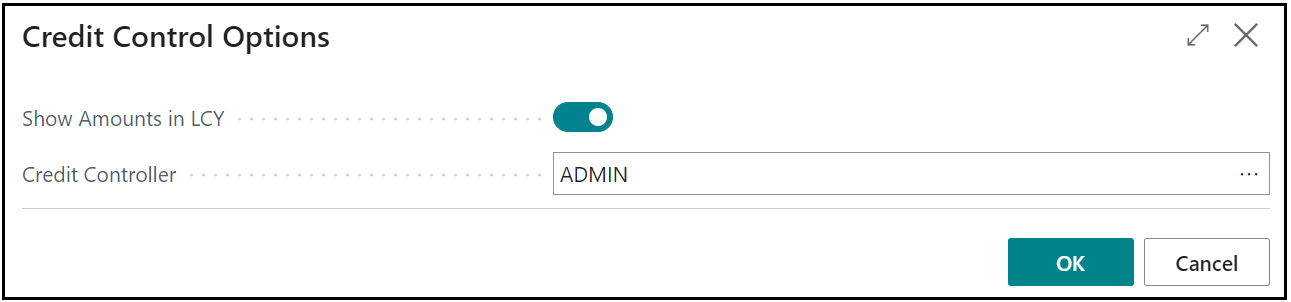

If you wish to change the view of Amounts (can be shown in LCY or Currency) or change the Credit Controller filter then click on Options in the ribbon and update the details, as shown below.

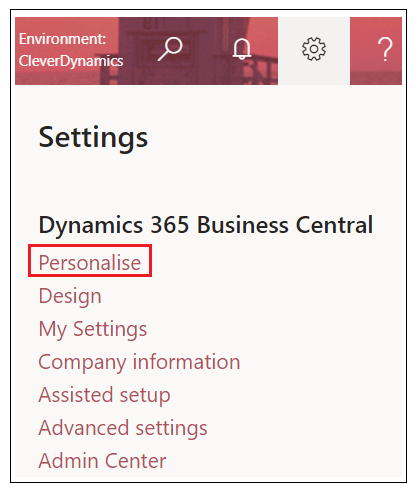

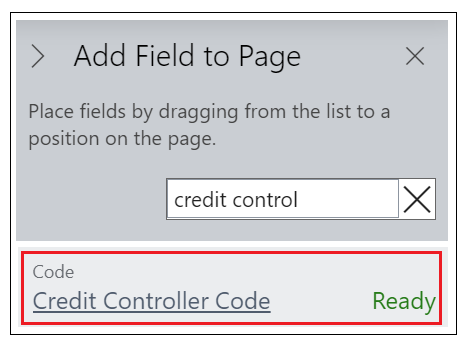

As well as the data visible immediately, there is also new data that can be added in via the Personalise function. Here, the Credit Controller Code field can be added into the "Clever Credit" page if the visibility for the assigned credit controller per Customer is useful.

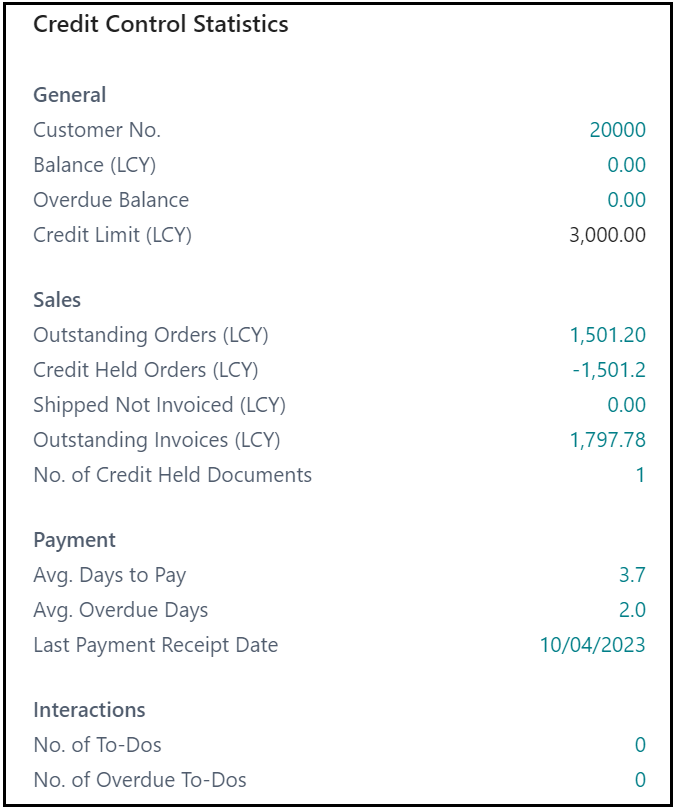

As shown below, the FactBox on the right also shows the Clever Credit Statistics, Clever Contact details and any existing interactions. Note that if Clever Credit is setup for Service (as well as Sales) then the FactBox will additionally show a Service section, with the same information as shown for Sales.

The No. of Credit Held Documents will display the value corresponding to the amount of documents that are in the "Credit Held List" as 'Held Documents'. This signifies that there are documents awaiting the decision to be released by the Credit Controller and cannot proceed until they are checked. This works the same for the No. of Service Credit Held Documents, which will instead show the held Service Documents.

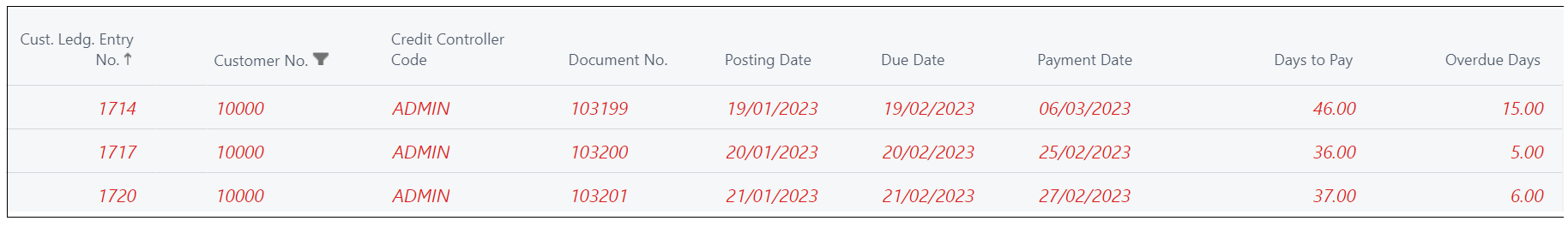

Other helpful fields are Avg. Days to Pay, Avg. Overdue Days and Last Payment Receipt Date. These show the state of the Customers previous payment activity where Avg. Days to Pay shows how many days the Payment Date was from the Posting Date of the invoice based on an average of all of the "Customer Ledger Entries", i.e. if Posting date was '01/06/2023' and the Payment Date was '27/06/2023', the calculation would show it took 26 days to pay for 1 "Customer Ledger Entry". If another "Customer ledger Entry" shows it took 30 days to pay then the average would calculate as 28 days. The Avg. Overdue Days is calculated as the amount of days the payment was received after its Due Date per Customer Ledger Entry and again, this field would show the average across all of the entries. Clicking into the values will display this data by ledger entry for more clarification.

The No of To-Do's and No. of Overdue To-Do's are also displayed here which gives the Credit Controller a helpful view of what is still left to do per Customer. As the Interactions is included in the Clever Credit Statistics FactBox, the values shown in the table will also be shown in the FactBox.

Charts

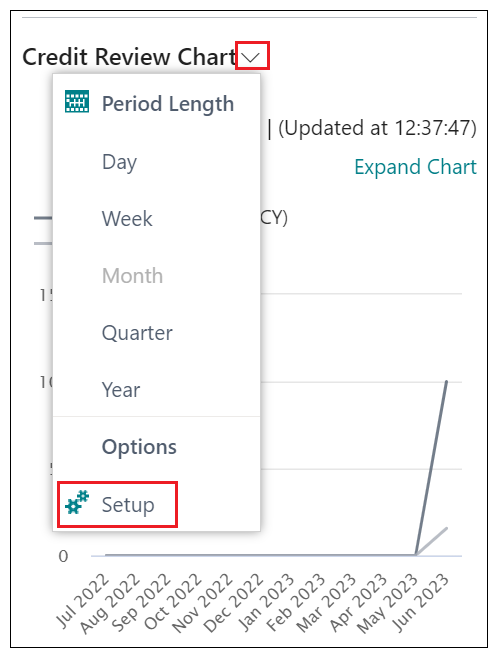

On the Credit Review Chart FactBox, there is a chart related to the Credit Limit Last Checked field from the "Customer card". This will be displayed for each customer and shows the increases to Credit Limit vs Balance over time. You can change the view settings or change the Setup where required.

In here, you can change the setup to Use Work Date as Base and by using the Expand Chart link the chart will be enlarged for easier viewing. For more information on how to use the Last Checked functionality, please refer to the Customer Card.

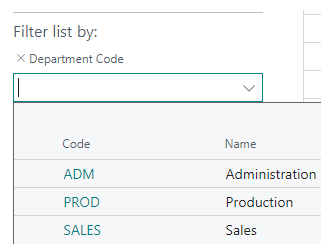

You can now also filter by your Global Dimensions in the "Customer Credit Status" page. In "General Ledger Setup", you'll have 2 Global Dimensions assigned to your business. These 2 Dimensions can now be used as filter options for you to then specify which code to filter by. This relies on your Customer "Default Dimensions" having these setup. This can benefit your business as you may wish to filter on only 'Sales' Customers using the example below to reduce the list of customers shown and speed up your internal credit check processes.

If using Clever Credit alongside Document Delivery

If Clever Document Delivery is installed, you can send out a statement to the Customer with the Send Email or Queue Email action. This function uses the Statement Doc Type Code value from the "Clever Credit Setup" page.

For more info about email sending please read the Clever Document Delivery documentation.