Once you have set up the Landed Cost Types these can be assigned to items by creating an Item Landed Cost which is then applied when the goods are bought in on purchase documents.

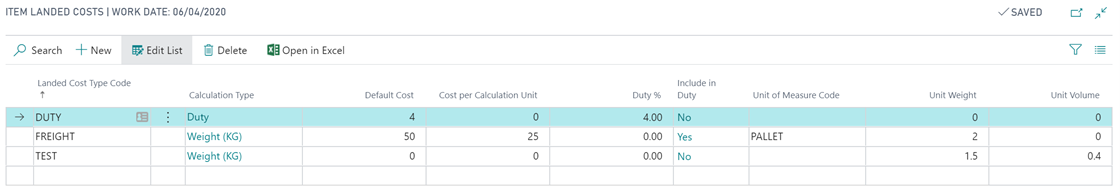

This page defines the expected cost, by Landed Cost Type, per base quantity of the item. The cost can, however, be entered in a different Unit of Measure Code for Landed Cost Types that have a Calculation Type of Weight or Volume.

In this case the Unit Weight and Unit Volume is copied from the corresponding Item Unit of Measure record and divided by the Qty. per Unit of Measure to give a weight and volume for a single unit. If the unit or weight is validated on the Item Unit of Measure is will be updated on any Item Landed Cost records that use that Unit of Measure Code.

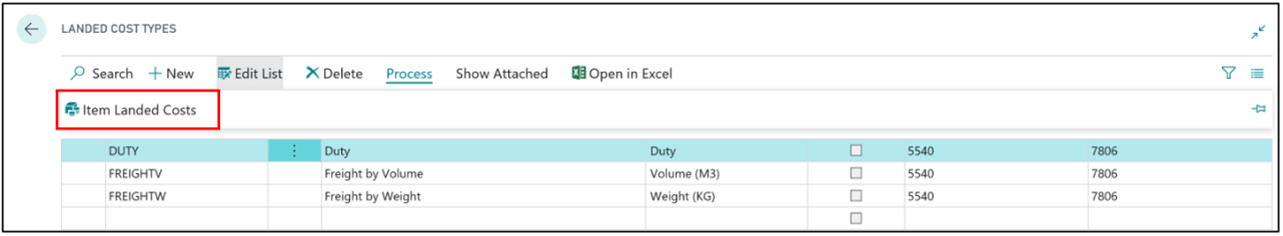

Find the Item Landed Costs page by first navigating to the Landed Cost Types page and click on Process > Item Landed Costs.

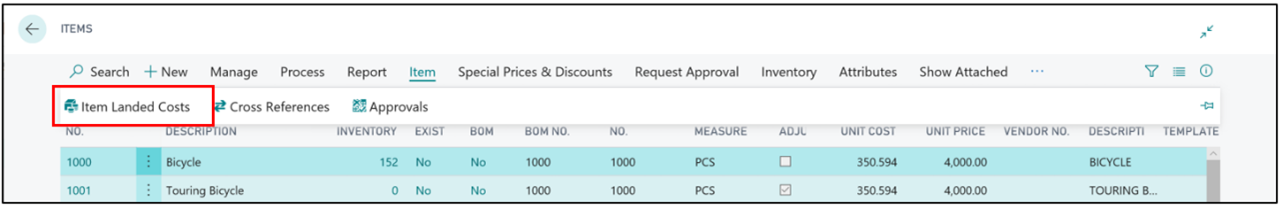

Alternatively go to the Items list page and use the Item button on the ribbon to view the associated Item Landed Costs for the selected Item in the list view.

Depending on how you end up on the Item Landed Costs page, you may need to either populate the Item Code if you went from the Landed Costs Type page or the Calculation Type if you went from the Items list.

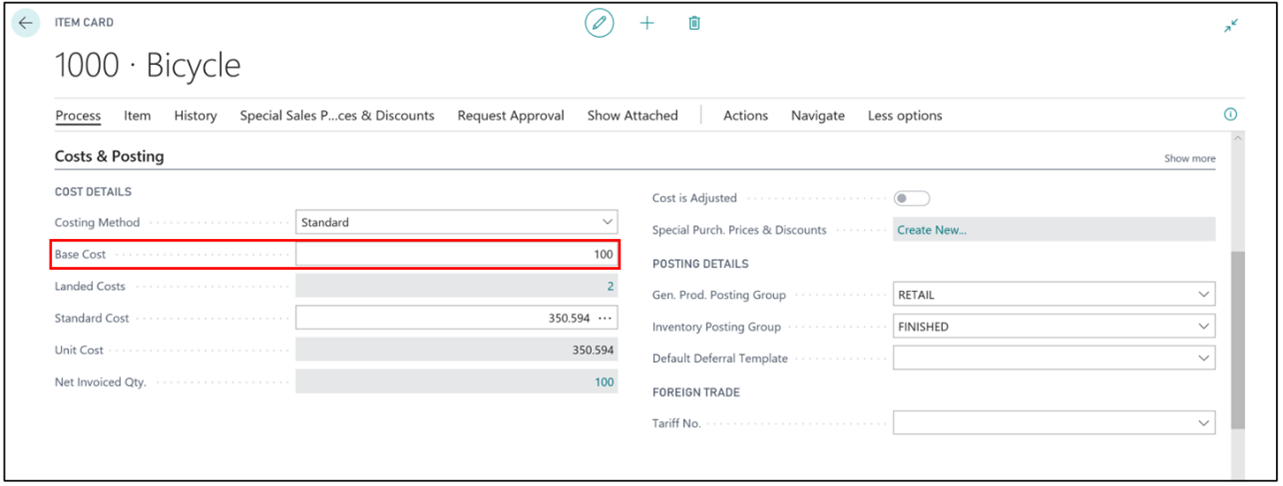

NB: The Base Cost is set on the item card.

The positive value in the Default Cost field is the total landed cost for a qty of 1 of the item. This is calculated differently depending on the Calculation Type. If the Calculation Type is;

-

Duty; the default cost is item card Base Cost*Duty %.

-

Weight (KG); the default cost is Cost per Calculation Unit*Unit Weight.

-

Volume (M3); the default cost is Cost per Calculation Unit*Unit Volume.

The next field along is Duty %, this can be entered manually but is also linked to the duty % for the tariff number on the item card.

Unit Weight/Unit Volume; these values are taken from the item card and are used in the calculation of default cost for freight based on either weight or volume.

NB: for non-Standard Costed items the duty is calculated as the Direct Unit Cost * Duty %