When you receive an Invoice for a Landed Cost you should register the costs through a "Purchase Invoice" within Dynamics 365 Business Central.

As part of Clever Landed Costs some additional functionality has been created to allow you to assign the Landed Cost(s) on the invoice to the "Posted Purchase Receipt" that it applies to, as detailed below.

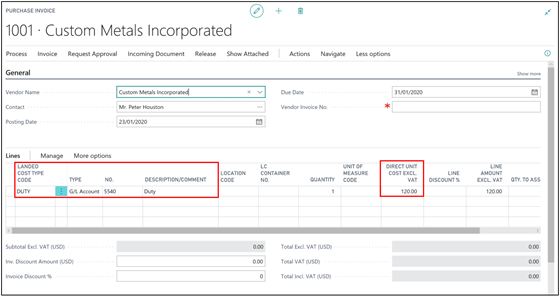

Create your "Purchase Invoice" for the Vendor as you would do for any other type of "Purchase Invoice" you need to process and then select the required Landed Cost Type Code on the Lines section of the Invoice. If you have a multi-line Invoice you can repeat this step as required so that your "Purchase Invoice" within Business Central mirrors the document you have received from your Vendor.

For each Invoice line, enter the Quantity and Direct Unit Cost Excl. VAT from the Invoice.

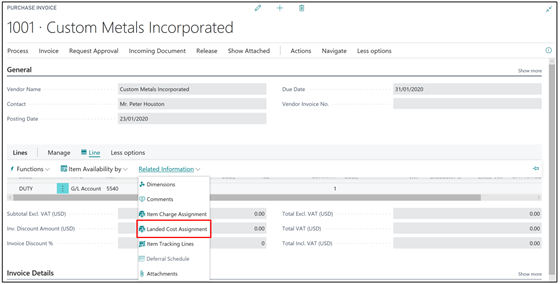

With all of the information entered onto the Invoice, the next step is to assign the Landed Cost Invoice lines to the related Purchase Receipts and related "Item Ledger Entries".

To do this click Line > Related Information > Landed Cost Assignment.

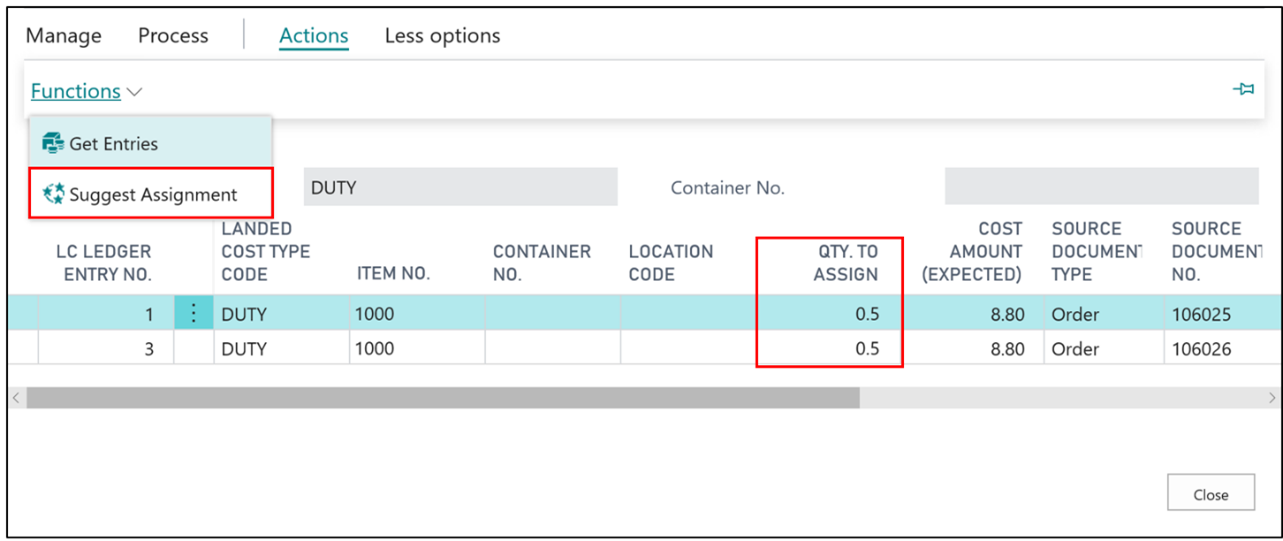

On the "Landed Cost Assignment" page click on Actions > Get Entries to select Inventory Receipts that you wish to allocate against the Invoice Line.

When the screen loads only receipt transactions that have not been allocated to an Invoice will be shown, but as shown on the example screenshot below you can select the Show Closed Entries option, which will then enable you to select transactions that already have an Actual Cost posted against them. This is important if you receive multiple Purchase Invoices for the same Landed Cost (e.g. Freight) so that you can capture the total cost against the receipt transactions.

Simply select all of the Entries that you wish to use and press OK to return to the Cost Assignment screen.

Note: in the "Get Entries" screen you can also select a Job No. to filter the suggested Item Ledger Entries by their Job No which can be useful where a third party has their own reference for containers which they quote on their correspondence.

In the LC Cost Assignment screen, press Suggest Assignment to assign the Invoice line value to the selected receipt transactions. If multiple receipts are being assigned the invoice is allocated in proportion to the Expected Landed Cost for each "Item Ledger Entry".

Click on Close to finalise the assignment and return back to the "Purchase Invoice".

The invoice can then be posted with the resulting "General Ledger Entries" showing the reversal of the expected and actual landed costs posted with any variances going to the account specified on the Landed Cost Type.

Note: Where Standard Cost is in use on an Item Card and multiple Landed Costs are assigned by different Locations using SKU's, then there will be no Purchase Price Variance recorded. This is because the Purchase order and Purchase Invoice are both received and posted at the same Base Cost.