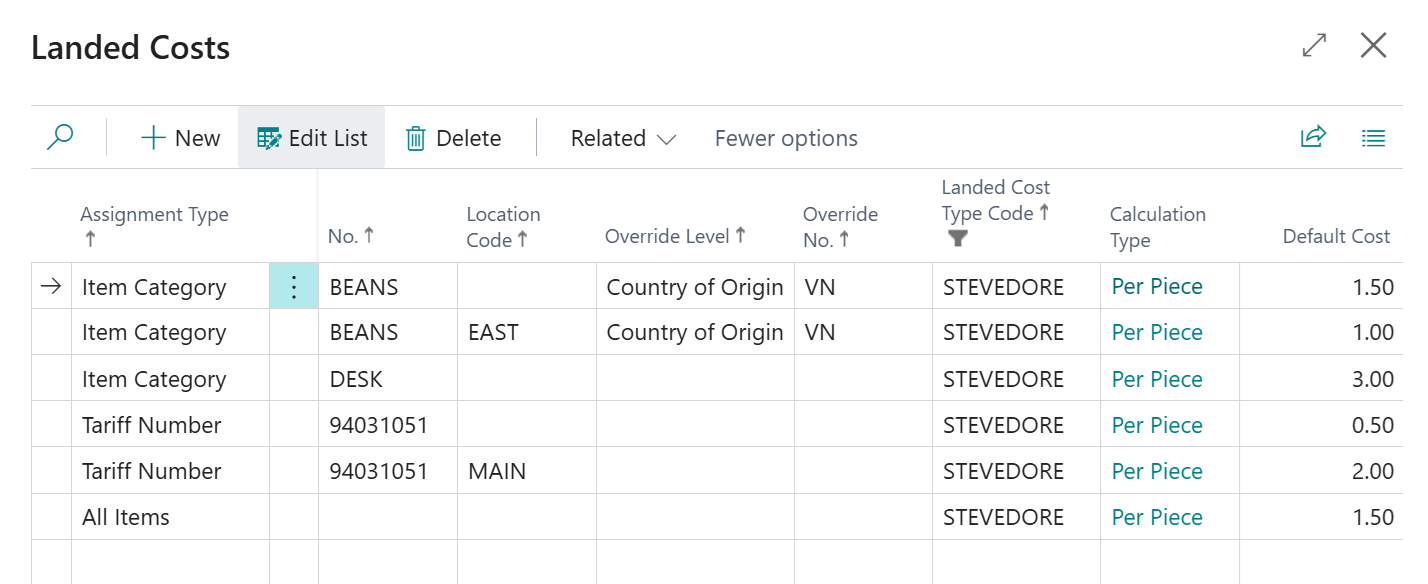

Once you have set up the "Landed Cost Types" that are relevant for your business, you can then assign the expected costs using the "Landed Costs" screen, which will then be populated onto Purchase Orders and registered upon receipt of goods.

With Clever Landed Costs you are able to assign and manage costs at the following levels, from the most specific through to the most generic.

-

Item

-

Tariff No. (Commodity Code)

-

Item Category Code

-

All Items

In addition to the above hierarchy, you can apply an override (within any level) against a "Vendor" or "Country of Origin", meaning that you have full flexibility for cost assignment if you procure the same type of goods from different Vendors or Countries, as things such as Duty may be different depending on such factors.

Finally - from Version 4.6.10 of Clever Landed Costs - it is possible to specify a Location Code so that you can define different cost setup when importing goods into different countries that you may have setup as Locations within Business Central. When matching cost setup against Purchase Order Lines the Location Code will take precedence before the above assignment factors. This means you will be able to assign out multiple Landed costs with the same Location Code using different Assignment Types.

The "Landed Costs" screen is shown below for reference and is accessible from the following screens within Business Central.

-

Landed Cost Types

-

Items

-

Tariff Nos. (Commodity Codes)

-

Item Categories

-

Vendors

-

Country/Regions

The "Landed Cost" screen is used to define the expected cost, by Landed Cost Type, per base quantity of the item. The cost can, however, be entered in a different unit of measure for Landed Cost Types that have a Calculation Type of Weight or Volume, in this case the Unit Weight and Unit Volume is copied from the corresponding Item Unit of Measure record and divided by the Qty. per Unit of Measure to give a weight and volume for a single unit. If the unit or weight is validated on the Item Unit of Measure is will be updated on any Item Landed Cost records that use that Unit of Measure Code.

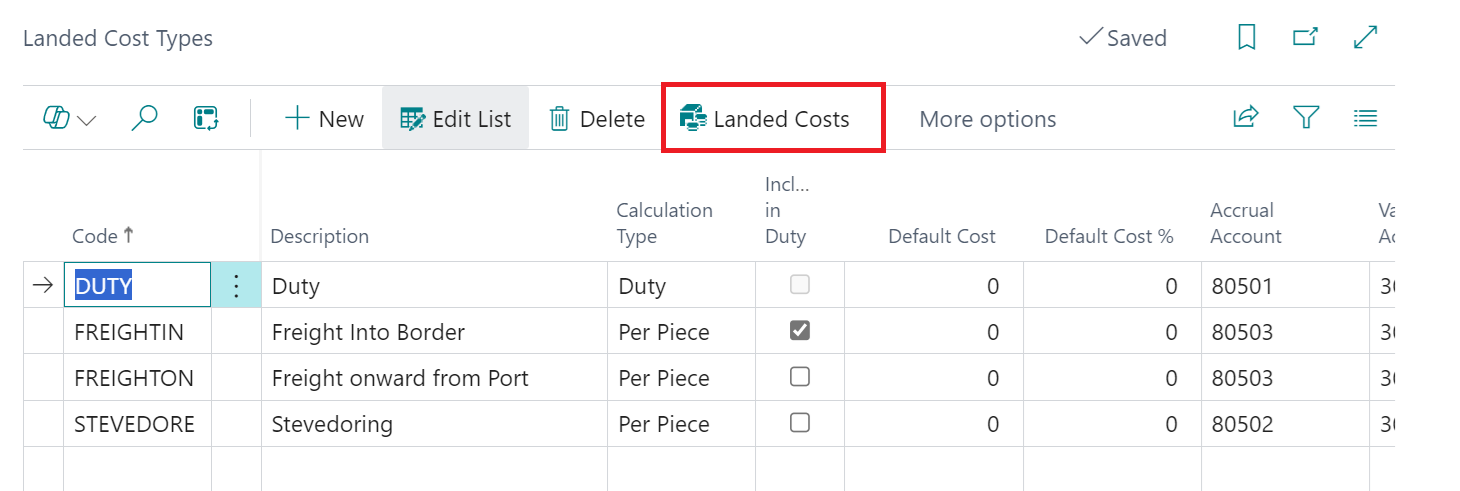

To manage "Landed Costs" from the "Landed Cost Types" level, simply select the Landed Costs option that is found on the "Landed Cost Types" screen, which will show all costs setup for the selected record. The same Landed Costs option is available on the screens documented above, from which the system will filter the "Landed Costs" for the selected record.

Depending on how you access the "Landed Costs" screen, the system will place filters on the data (e.g. if from "Landed Cost Types" the Landed Cost Type Code will be entered automatically, or from the "Item" screen the you may need to either populate the Item Code if you went from the Landed Costs Type page or the Calculation Type if you went from the Items list.

The attributes that are shown on the "Landed Cost" screen and are to be setup as detailed to ensure that the costs will be associated to the relevant Items through the purchase process.

| Assignment Type |

This attribute is used to control the whether a Landed Cost applies to All Items, a specific Item, Tariff No. or Item Category. Note: if left blank the system will show an error when you attempt to create the Landed Cost record |

| No. |

The No. field is related to the Assignment Type and will show an appropriate lookup list based on the Assignment Type selected, as follows.

|

| Location Code | This is not required, but will allow you to setup different rates for each Location you have setup within Business Central, where you may have different cost liabilities for different regions or Countries that you manage from within Business Central as Locations. |

| Override Level | This is not required, but allows to add further criteria for either Vendor or Country of Origin in addition to the Assignment Type. This means that you can (as an example) setup a different Duty % for the same Item if you purchase from a different Country of Origin. |

| Override No. |

The Override No. is used alongside the Override Level and will show a lookup to the related data as follows, from which the user can choose the relevant option.

|

| Landed Cost Type Code | This is the Landed Cost Type for which the assignment is relevant. |

| Calculation Type | The Calculation Type is copied from the specified Landed Cost Type Code record for reference and used to calculate the Default Cost, as specified below |

| Default Cost |

The value in the Default Cost represents the unit cost of the "Landed Cost". This is calculated differently depending on the Calculation Type. If the Calculation Type is;

NB: for non-Standard Costed items the duty is calculated as the Direct Unit Cost * Duty % |

| Cost per Calculation Unit | If using such Calculation Type as Weight (KG) or Volume (M3) you can enter the cost per KG or M3. Alternatively if you enter the cost in the Default Cost field manually (as a cost against the UoM for an Item) then the Cost per Calculation Unit will be calculated to convert to either KG or M3 |

|

Duty % |

This can be entered manually but is also linked to the Duty % for the tariff number related to the Item or if the Assignment Type is Tariff No. |

| Cost % | This is entered manually if the Calculation Type is set to Percent |

| Include in Duty | This is a reference to the same field on the related "Landed Cost Type" record |

| Unit of Measure Code | For Items, this is the Base Unit of Measure |

| Unit Weight | This value is populated from the item card and are used in the calculation of default cost for freight based on either weight or volume |

| Unit Volume | This value is populated from the item card and are used in the calculation of default cost for freight based on either weight or volume |

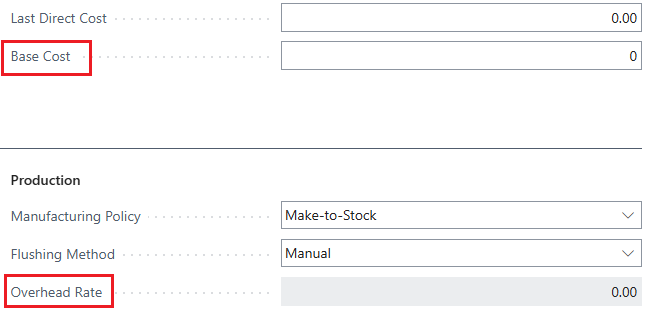

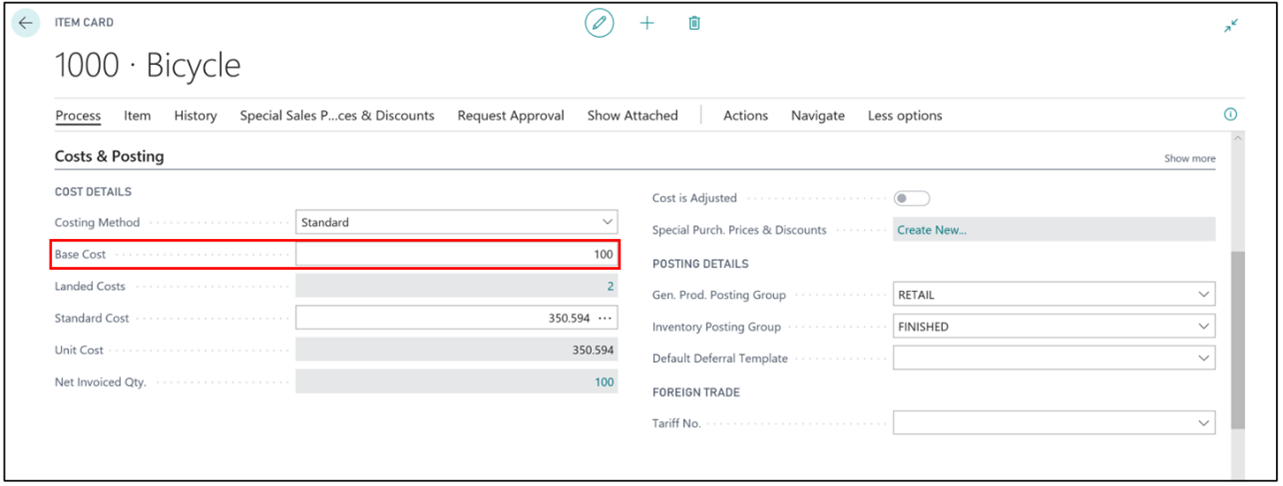

Note: The Base Cost used in some of the calculations detailed above is set on the item card, as shown below.

From Version 4.6.11, the Base Cost & Overhead Rate have also be added to Stockkeeping Units (SKUs) and where SKUs are in use inside of Business Central, the Overhead Rate will be calculated when assigning Landed Costs against a specific Item and Location combination, as represented by the SKU. The Item Overhead Rate is populated for Item Landed Costs which are setup against Items, but where no Location Code is assigned.

When using SKU functionality, then if necessary (the Base Cost of the Item is different depending on receiving Location) you should maintain the Base Cost against the SKU, rather than the Item. This is because it will be used in the above calculations in priority of the Item Base Cost. If not set, the Base Cost from the Item will be used.